Want to become rich? Invest in our Mutual Fund Portfolios - The Economic Times on Mobile

Want to become rich? Invest in our Mutual Fund Portfolios

ECONOMICTIMES.COM|

Updated: Oct 11, 2016, 04.20 PM IST

Here are a few mutual fund portfolios for investors with different risk profiles as well as SIP investment amounts.

Everybody knows that the easy to way to create wealth for long-term financial goals is to start a Systematic Investment Plan (SIP) in equity mutual fund schemes. However, many individuals never actually start a SIP because they find it extremely difficult to choose the right schemes to invest.

That excuse is no more valid. ET.com has created a few mutual fund portfolios for investors with different risk profiles as well as SIP investment amounts. The three risk profiles chosen are: conservative, moderate and aggressive. We have also considered three SIP baskets: Rs 2,000-5,000, Rs 5,000-10,000 and above Rs 10,000. We have only considered equity diversified and equity-oriented balanced funds for the purpose of recommendation. We have also assumed that the investor is investing with an investment horizon of five years.

ET MF has employed the following parameters for short-listing the mutual funds.

1. Mean Rolling returns rolled daily for the last 3 years

2. Consistency for the last 3 years : The 3 year period is divided into smaller time periods each with a progressing weighting.

3. Downside risk : In this case, we have considered only the negative returns given by the mutual fund scheme.

X =Returns below zero

Y = Sum of all squares of X

Z = Y/number of days taken for computing the ratio

Downside risk = Square root of Z

4. Outperformance : Measured by Jensen's Alpha for the last three years. Jensen' Alpha shows the risk-adjusted return generated by a mutual fund scheme relative to the expected market return predicted by the Capital Asset Pricing Model (CAPM). Higher Alpha indicates that the portfolio performance has outstripped the returns predicted by the market.

Average return generated by the MF Scheme - [Risk Free Rate + Beta of the MF Scheme * {(Average return of the index - Risk Free Rate}]

5. Asset Size: For equity diversified funds, the threshold asset size is Rs 100 crore, whereas the threshold corpus taken is Rs 50 crore for balanced funds.

That excuse is no more valid. ET.com has created a few mutual fund portfolios for investors with different risk profiles as well as SIP investment amounts. The three risk profiles chosen are: conservative, moderate and aggressive. We have also considered three SIP baskets: Rs 2,000-5,000, Rs 5,000-10,000 and above Rs 10,000. We have only considered equity diversified and equity-oriented balanced funds for the purpose of recommendation. We have also assumed that the investor is investing with an investment horizon of five years.

ET MF has employed the following parameters for short-listing the mutual funds.

1. Mean Rolling returns rolled daily for the last 3 years

2. Consistency for the last 3 years : The 3 year period is divided into smaller time periods each with a progressing weighting.

3. Downside risk : In this case, we have considered only the negative returns given by the mutual fund scheme.

X =Returns below zero

Y = Sum of all squares of X

Z = Y/number of days taken for computing the ratio

Downside risk = Square root of Z

4. Outperformance : Measured by Jensen's Alpha for the last three years. Jensen' Alpha shows the risk-adjusted return generated by a mutual fund scheme relative to the expected market return predicted by the Capital Asset Pricing Model (CAPM). Higher Alpha indicates that the portfolio performance has outstripped the returns predicted by the market.

Average return generated by the MF Scheme - [Risk Free Rate + Beta of the MF Scheme * {(Average return of the index - Risk Free Rate}]

5. Asset Size: For equity diversified funds, the threshold asset size is Rs 100 crore, whereas the threshold corpus taken is Rs 50 crore for balanced funds.

READ MORE :wealth creation | Wealth | SIP | portfolio | mutual fund | investing | invest

Comments

Add Your Comments

Mutual Fund queries answered by Manoj Nagpal, CEO, Outlook Asia Capital

NEXT STORY

Mutual Fund queries answered by Manoj Nagpal, CEO, Outlook Asia Capital

Updated: Oct 10, 2016, 02.47 PM IST

Since you have a 3-year investment period but a longer investment horizon, it will be prudent to build a portfolio which can take advantage of longer term trends.

I am a 19-year-old student. I want to be financially independent and arrange money for my post-graduation expenses (around Rs 5 lakh within 5 years). For this purpose, I invested Rs 2,500 in Kotak Emerging Equity Scheme through a systematic investment plan (SIP). Can you give me some valuable suggestions on whether this fund is suitable for my financial goal?

Juzer M

You have a medium term goal with a definite time frame which cannot be realigned in case of sudden market volatility at the beginning of your post-graduation. To plan for such goals, one should ideally build an investment vehicle which will guard against sudden market movements, especially closer to the time frame. You have chosen Kotak Emerging Equity Scheme which has a smallcap and midcap orientation and at the end of 3-4 years you should reduce the risk in your portfolio by realigning the risk to lower volatility asset class and turn to a savings mode. To achieve your goal, you will need to increase your investment amount.

I am 57 years old, due to retire in 2019. I wish to start a SIP for Rs 3,000-5,000 per month to build a corpus, however small, for my school-going son. Please suggest some equity-based mutual funds.

Manhar Shukul

Since you have a 3-year investment period but a longer investment horizon for your son, it will be prudent to build a portfolio which can take advantage of longer term trends. You could consider a multi-cap fund like DSP Opportunities Fund as the core holding flanked by two diversified trend funds like Birla GenNext Fund and Sundaram Rural India Fund. On the other hand, if your time horizon is shorter at around 5-7 years, only then you could consider adding the Birla Advantage Fund and Quantum Long Term Equity Fund instead of the later two trend funds.

I started investing in mutual funds (Rs 1,500 in each fund) 2 years back. Please suggest/advice on my SIP portfolio as below: Franklin Build India Fund (since February 2015), Franklin High Growth Companies Fund (since February 2015), SBI BlueChip Fund (since December 2014), SBI Small & MidCap Fund (since December 2014), Canara Robeco Emerging Equities Fund (since January 2016), Axis Equity Fund ELSS (since April 2016). Kindly advise if these funds are good enough or do I need to change them?

Rahul Dev Singhal

You could consider consolidation of your SIPs and simultaneously reducing the midcap component in your investments if you wish to reduce volatility and risk of the portfolio. With these objectives you should increase the SIP amounts in Franklin Build India Fund, SBI BlueChip Fund and discontinue the Franklin High Growth Cos, SBI Small & MidCap Fund and Axis Fund. You can continue the Canara Robeco Emerging Equities Fund as the midcap exposure. With this strategy, you will reduce the risk, weed out the lesser performers and consolidate your portfolio for better management.

(Send your queries on mutual funds to et.mfs@timesgroup.com)

Juzer M

You have a medium term goal with a definite time frame which cannot be realigned in case of sudden market volatility at the beginning of your post-graduation. To plan for such goals, one should ideally build an investment vehicle which will guard against sudden market movements, especially closer to the time frame. You have chosen Kotak Emerging Equity Scheme which has a smallcap and midcap orientation and at the end of 3-4 years you should reduce the risk in your portfolio by realigning the risk to lower volatility asset class and turn to a savings mode. To achieve your goal, you will need to increase your investment amount.

I am 57 years old, due to retire in 2019. I wish to start a SIP for Rs 3,000-5,000 per month to build a corpus, however small, for my school-going son. Please suggest some equity-based mutual funds.

Manhar Shukul

Since you have a 3-year investment period but a longer investment horizon for your son, it will be prudent to build a portfolio which can take advantage of longer term trends. You could consider a multi-cap fund like DSP Opportunities Fund as the core holding flanked by two diversified trend funds like Birla GenNext Fund and Sundaram Rural India Fund. On the other hand, if your time horizon is shorter at around 5-7 years, only then you could consider adding the Birla Advantage Fund and Quantum Long Term Equity Fund instead of the later two trend funds.

I started investing in mutual funds (Rs 1,500 in each fund) 2 years back. Please suggest/advice on my SIP portfolio as below: Franklin Build India Fund (since February 2015), Franklin High Growth Companies Fund (since February 2015), SBI BlueChip Fund (since December 2014), SBI Small & MidCap Fund (since December 2014), Canara Robeco Emerging Equities Fund (since January 2016), Axis Equity Fund ELSS (since April 2016). Kindly advise if these funds are good enough or do I need to change them?

Rahul Dev Singhal

You could consider consolidation of your SIPs and simultaneously reducing the midcap component in your investments if you wish to reduce volatility and risk of the portfolio. With these objectives you should increase the SIP amounts in Franklin Build India Fund, SBI BlueChip Fund and discontinue the Franklin High Growth Cos, SBI Small & MidCap Fund and Axis Fund. You can continue the Canara Robeco Emerging Equities Fund as the midcap exposure. With this strategy, you will reduce the risk, weed out the lesser performers and consolidate your portfolio for better management.

(Send your queries on mutual funds to et.mfs@timesgroup.com)

Comments (5)

Add Your Comments

Investing in small-cap or mid-cap funds? Check their liquidity

SIGN UP FOR WEALTH EDITION.

Most read weekly newsletter from the Economic Times with 2.1 million + subscribers view sample

Subscribe

Investing in small-cap or mid-cap funds? Check their liquidity

By

, ET Bureau|Sanket Dhanorkar

Oct 10, 2016, 06.30 AM IST

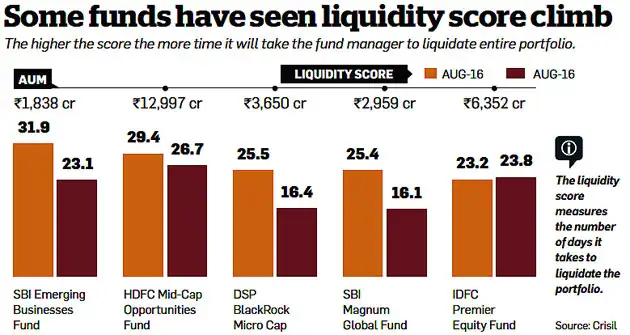

Currently, some mid- and small-cap funds may be sacrificing liquidity in their pursuit of higher alpha.

Over the past few years, equity funds have delivered handsome returns, riding on the uptick in the stock market. Mid- and small-cap funds have particularly benefited, delivering huge alpha—or outperformance— over the market. Midcap and small-cap funds have averaged 34.2% and 42% CAGR respectively over the past three years, compared to 17.7% by largecap funds. The stellar performance has attracted more investors to this basket, leading to a surge in inflows and a burgeoning asset size for many funds. But are these midand small-cap funds sacrificing liquidity in pursuit of alpha? Would they be caught on the wrong foot if the market sentiment weakens?

Heading towards a liquidity trap

Data from Crisil suggests that some mid- and small-cap funds have seen their liquidity profile deteriorate over the past year. Crisil’s portfolio liquidity score measures the ease with which a portfolio can be liquidated. The lower the score, the better it is. In simple terms, it measures the number of days it would take to liquidate the entire portfolio.

Mid- and small-cap funds have seen their liquidity score climb from 9.01 to 11.91 over the past one year. This means that the funds would take on an average up to 12 days to liquidate their entire portfolios at this juncture. Some funds have a liquidity score in excess of 25 days (see table). In contrast, large-cap funds have a liquidity score of 1.1—nearly unchanged from a year ago—implying that a fund will take just a day to liquidate its positions. Diversified equity funds, also known as multi-cap funds, also have a relatively stable liquidity position.

Jiju Vidyadharan, Director, Funds and Fixed Income Research, Crisil, feels liquidity is not a concern at this point. “We do not see a significant trend towards illiquid stocks for now. The portfolio liquidity score is partly an outcome of the increase in size of the funds." Manoj Nagpal, CEO, Outlook Asia Capital, however, says the liquidity position of mid- and small-cap funds could be far worse than what is visible now. “Liquidity in mid- and small-cap stocks can vary significantly during bull and bear phases. Right now, the liquidity is comfortable as this segment is in the grips of a bull market. But when the music stops, these can lose liquidity rapidly and at that time, the liquidity position of funds will be worse than it is now."

But why should you as an investor be bothered about a fund’s liquidity position? Liquidity refers to how easily the shares can be bought or sold in the market without significant loss of value. If a fund has too many illiquid stocks in its portfolio, the fund manager will be in trouble in the face of large scale redemptions. Unlike a large cap fund, the fund manager of a mid- or small-cap equity fund has to grapple with the liquidity position of his portfolio. This is because, apart from a few counters, most stocks in this segment do not enjoy healthy trading volumes on the exchanges. When redemptions are high, fund managers can meet the cash requirement by either selling some of the better performing stocks that have enough liquidity, or dumping any of the liquidity-starved stocks at lower prices.

The latter scenario can really hurt a fund’s return profile. Roopali Prabhu, Head of Investment Products, Sanctum Wealth Management, points out, “Exiting the illiquid positions in an adverse market may have a higher impact cost for the fund." Some experts say fund managers have recently admitted that the actual realisable NAV (net asset value) of the fund is lower than the current NAV, owing to the liquidity overhang.

Ensuring liquidity can be particularly tricky as the fund corpus swells in size. When the size of the fund goes up, the fund manager may be forced to diversify his holdings by including more stocks in his portfolio. But there are only limited investible opportunities in this segment. After the relentless uptick in prices of mid- and smallcap stocks over the past few years, quality investible ideas are scarce. But as the fund continues to attract more inflows, the fund manager may resort to hunting lower down the market capitalisation ladder for high alpha ideas as valuations for existing high quality stocks are already rich. This presents a liquidity trap for the fund, apart from the quality dilution in the portfolio.

The other option for the fund manager is to put more money into large-caps that offer sufficient liquidity but could potentially dilute the return profile of the fund. But experts contend that funds should be using another alternative in the current scenario—to stop accepting further investor money into the funds. Recently, DSP BlackRock Micro Cap and SBI Small and Midcap exercised this option. With fresh inflows restricted, the fund manager can manoeuvre the existing portfolio without having to worry about deploying money in an already heated market.

Heading towards a liquidity trap

Data from Crisil suggests that some mid- and small-cap funds have seen their liquidity profile deteriorate over the past year. Crisil’s portfolio liquidity score measures the ease with which a portfolio can be liquidated. The lower the score, the better it is. In simple terms, it measures the number of days it would take to liquidate the entire portfolio.

Mid- and small-cap funds have seen their liquidity score climb from 9.01 to 11.91 over the past one year. This means that the funds would take on an average up to 12 days to liquidate their entire portfolios at this juncture. Some funds have a liquidity score in excess of 25 days (see table). In contrast, large-cap funds have a liquidity score of 1.1—nearly unchanged from a year ago—implying that a fund will take just a day to liquidate its positions. Diversified equity funds, also known as multi-cap funds, also have a relatively stable liquidity position.

Jiju Vidyadharan, Director, Funds and Fixed Income Research, Crisil, feels liquidity is not a concern at this point. “We do not see a significant trend towards illiquid stocks for now. The portfolio liquidity score is partly an outcome of the increase in size of the funds." Manoj Nagpal, CEO, Outlook Asia Capital, however, says the liquidity position of mid- and small-cap funds could be far worse than what is visible now. “Liquidity in mid- and small-cap stocks can vary significantly during bull and bear phases. Right now, the liquidity is comfortable as this segment is in the grips of a bull market. But when the music stops, these can lose liquidity rapidly and at that time, the liquidity position of funds will be worse than it is now."

But why should you as an investor be bothered about a fund’s liquidity position? Liquidity refers to how easily the shares can be bought or sold in the market without significant loss of value. If a fund has too many illiquid stocks in its portfolio, the fund manager will be in trouble in the face of large scale redemptions. Unlike a large cap fund, the fund manager of a mid- or small-cap equity fund has to grapple with the liquidity position of his portfolio. This is because, apart from a few counters, most stocks in this segment do not enjoy healthy trading volumes on the exchanges. When redemptions are high, fund managers can meet the cash requirement by either selling some of the better performing stocks that have enough liquidity, or dumping any of the liquidity-starved stocks at lower prices.

The latter scenario can really hurt a fund’s return profile. Roopali Prabhu, Head of Investment Products, Sanctum Wealth Management, points out, “Exiting the illiquid positions in an adverse market may have a higher impact cost for the fund." Some experts say fund managers have recently admitted that the actual realisable NAV (net asset value) of the fund is lower than the current NAV, owing to the liquidity overhang.

Ensuring liquidity can be particularly tricky as the fund corpus swells in size. When the size of the fund goes up, the fund manager may be forced to diversify his holdings by including more stocks in his portfolio. But there are only limited investible opportunities in this segment. After the relentless uptick in prices of mid- and smallcap stocks over the past few years, quality investible ideas are scarce. But as the fund continues to attract more inflows, the fund manager may resort to hunting lower down the market capitalisation ladder for high alpha ideas as valuations for existing high quality stocks are already rich. This presents a liquidity trap for the fund, apart from the quality dilution in the portfolio.

The other option for the fund manager is to put more money into large-caps that offer sufficient liquidity but could potentially dilute the return profile of the fund. But experts contend that funds should be using another alternative in the current scenario—to stop accepting further investor money into the funds. Recently, DSP BlackRock Micro Cap and SBI Small and Midcap exercised this option. With fresh inflows restricted, the fund manager can manoeuvre the existing portfolio without having to worry about deploying money in an already heated market.

READ MORE :wealth management | Smallcap stocks | midcap funds | investment | DSP Blackrock | Crisil

Comments (4)

Add Your Comments

5 smart things to know about functions of a fund manager

SCHEME NAME

RATING

1 M

(%)

(%)

3 M

(%)

(%)

6 M

(%)

(%)

1 YR

(%)

(%)

3 YRS

(%)

(%)

- Top rated funds sorted on 1 year return.

- Returns less then 1 year are absolute and above 1 year are annualised.

5 smart things to know about functions of a fund manager

Oct 10, 2016, 06.30 AM IST

Fund managers conduct in-depth analysis of the market environment, make the asset allocation decisions and ensure that funds operate as per regulations.

1. Fund managers need to conduct in-depth analysis of the market environment, macroeconomic factors and sectoral outlooks to identify investment opportunities.

2. Fund manager also make the asset allocation decisions and the securities buy and sell decisions based on the investment objective of the fund.

3. Fund managers are judged by how well their fund performs. At the least, they need to deliver growth exceeding interest and inflation rate and the fund benchmark, to justify the risk of investing.

4. On a daily basis, fund managers are in charge of placing orders and buying or selling individual stocks and bonds from the portfolio, as well as managing cash flows and redemption.

5. Fund managers must also ensure that their funds operate in accordance with the regulations outlined by Sebi, and that their funds’ reporting requirements are met.

(The content on this page is courtesy Centre for Investment Education and Learning (CIEL). Contributions by Girija Gadre, Arti Bhargava and Labdhi Mehta.)

2. Fund manager also make the asset allocation decisions and the securities buy and sell decisions based on the investment objective of the fund.

3. Fund managers are judged by how well their fund performs. At the least, they need to deliver growth exceeding interest and inflation rate and the fund benchmark, to justify the risk of investing.

4. On a daily basis, fund managers are in charge of placing orders and buying or selling individual stocks and bonds from the portfolio, as well as managing cash flows and redemption.

5. Fund managers must also ensure that their funds operate in accordance with the regulations outlined by Sebi, and that their funds’ reporting requirements are met.

(The content on this page is courtesy Centre for Investment Education and Learning (CIEL). Contributions by Girija Gadre, Arti Bhargava and Labdhi Mehta.)

Comments (1)

Add Your Comments

Should you invest in Sovereign gold bonds or gold ETFs?

NEXT STORY

Should you invest in Sovereign gold bonds or gold ETFs?

Updated: Oct 10, 2016, 10.24 AM IST

Even though the gold bonds are backed by the Government of India, the returns are linked to price movements in gold and are therefore not guaranteed.

Sunita is a working woman nearing 50, who wants to set aside some gold for her daughter’s wedding. Her banker friend has told her about sovereign gold bonds and gold ETFs as substitutes for physical gold. While the gold ETFs have been around, the bonds are fairly new in the market. They are issued by the Government of India in tranches and in various denominations. The amount invested will be redeemed at the price of gold at that time in about eight years. Sunita is wondering if she should invest in the bonds or ETFs.

Both the gold bonds and ETFs will allow Sunita to invest in gold on paper, rather than buy physical gold. But she must remember that even though the gold bonds are backed by the Government of India, the returns are linked to price movements in gold, and are therefore not guaranteed. In this respect, both ETFs and sovereign bonds carry similar market risk. The values of the gold bonds and ETFs are based on the gold price of .999 purity and .995 purity respectively.

A key differentiator for sovereign gold bonds is the feature of an additional interest of 2.75% per annum, which is computed based on the investment value of gold. This interest on the gold bond is accumulated over and above the appreciation in the value of gold. Further, the costs involved in ETF investments (demat charges, brokerage and expense ratio) would essentially lower Sunita’s investment amount, and in turn, her return.

In order to mitigate risks from any steep price corrections closer to the redemption date, the bonds would provide Sunita the option of rolling over her investment for a further period of at least three years. If Sunita were to redeem these bonds at maturity, her capital gains would be tax-free. However, in terms of capital gains arising out of trading, gold bonds and ETFs are on a level playing field. The interest income earned from the bonds will be subject to taxation, similar to a bank deposit. However, no TDS is applicable to the interest earned from these bonds.

Since Sunita intends to save for her daughter’s wedding, the bonds are the better option for her, because they will allow her to accumulate gold at a lower cost, with additional interest and tax benefits. However, if she wants to buy smaller denominations than a gram, she would have to opt for gold ETFs. Either way, her investment will be subject to market risks.

( The content on this page is courtesy Centre for Investment Education and Learning (CIEL). Contributions by Girija Gadre, Arti Bhargava and Labdhi Mehta .)

Both the gold bonds and ETFs will allow Sunita to invest in gold on paper, rather than buy physical gold. But she must remember that even though the gold bonds are backed by the Government of India, the returns are linked to price movements in gold, and are therefore not guaranteed. In this respect, both ETFs and sovereign bonds carry similar market risk. The values of the gold bonds and ETFs are based on the gold price of .999 purity and .995 purity respectively.

A key differentiator for sovereign gold bonds is the feature of an additional interest of 2.75% per annum, which is computed based on the investment value of gold. This interest on the gold bond is accumulated over and above the appreciation in the value of gold. Further, the costs involved in ETF investments (demat charges, brokerage and expense ratio) would essentially lower Sunita’s investment amount, and in turn, her return.

In order to mitigate risks from any steep price corrections closer to the redemption date, the bonds would provide Sunita the option of rolling over her investment for a further period of at least three years. If Sunita were to redeem these bonds at maturity, her capital gains would be tax-free. However, in terms of capital gains arising out of trading, gold bonds and ETFs are on a level playing field. The interest income earned from the bonds will be subject to taxation, similar to a bank deposit. However, no TDS is applicable to the interest earned from these bonds.

Since Sunita intends to save for her daughter’s wedding, the bonds are the better option for her, because they will allow her to accumulate gold at a lower cost, with additional interest and tax benefits. However, if she wants to buy smaller denominations than a gram, she would have to opt for gold ETFs. Either way, her investment will be subject to market risks.

( The content on this page is courtesy Centre for Investment Education and Learning (CIEL). Contributions by Girija Gadre, Arti Bhargava and Labdhi Mehta .)

READ MORE :TDS | sovereign gold bonds | Gold bonds | ETFs | ET Wealth | demat

Comments (3)

Add Your Comments

Source: m.economictimes.com